News

Contact

It’s your retirement, you should have control over it. We offer our experience and knowledge to help you design a custom strategy for financial independence. Contact us today to schedule an introductory meeting!

Request An Appointment

[contact-form-7 id=”1020″ title=”Contact Page”]

Services

How We Can Help

Our mission is to generationally change the way financial planning works when it comes to:

- Saving for your children’s education

- Planning for your own retirement

- Protecting the ones you love and the home they live in

Investing in all three can be expensive. Partnering with the IRS can be devastating. Unlocking a whole new way to approach these dreams and milestones with a tax smart approach is what the 930 plan is all about.

Retirement Planning

No matter where you are in life, we can provide you the guidance, tools, and services to help prepare for retirement on your terms.

Income Strategies

Learn about income strategies for guaranteed lifetime income that can help you maintain your lifestyle now and in retirement.

Insurance Reviews

Life can change – the birth of a child, the death of a loved one, the loss of a job, a major purchase – which will readjust your customized strategy.

Annuities

Are you in or near retirement? Learn how annuities can help generate a reliable stream of income or increase your current savings.

Life Insurance

A reliable insurance strategy could help protect you and your family from the financial consequences of major life events.

Social Security Optimization

We can help you understand your Social Security benefits and educate you on how you can maximize those retirement benefits.

Tax Planning

Understanding how tax strategies are used to manage your tax bill should be a major part of any reliable financial approach.

Money Management

One of the keys to a reliable financial strategy is spending less than you take in, and then finding a way to put your excess to work.

Investment Strategies

Investing is about proper planning to achieve your financial goals: retirement, paying college, or just providing for your family.

Employee Benefits

Creating a plan that balances the goals of both the organization and its employees requires thorough analysis and review of benefit options and costs.

Long-Term Care

Chances are you could live well into your 80s and 90s, or longer. A long life greatly increases the likelihood you’ll require long-term health care.

Estate Planning

Effective estate management enables you to manage your affairs during your lifetime and control the distribution of your wealth after death.

Financial Education Courses

I’m an instructor with Adult Financial Education Services (AFES), specializing in planning and guidance for those who are seeking a better lifestyle and a guaranteed income in retirement.

Lifestyle Planning

Lifestyle matters look at how to balance work and leisure efficiently, how to make smart choices for the future, as well as many other items regarding how to help you enjoy the journey.

About

Our Company Values

For those who are looking for financial advice, we realize the available options are many and deciding who to work with is a challenging problem. Listed below are our Company Values which we hope will give you a better understanding of how we operate.

- People Matter – We believe that each person is innately valuable and worthy of respect and honor. We believe that relationships matter and that business is relational, top to bottom. People First, Money Second is a priority statement that places people and relationships ahead of financial matters.

- Integrity Matters – We believe that integrity and truth matter. We believe we need to conduct our business in such a way that we are “above reproach. We believe suitability and ethical practices come from placing a high value on other people and their needs before our own.

- Communication Matters – We believe that communication with our client partners builds and maintains the trust that is necessary for business relationships to reach their full potential. We believe that our client partners deserve the type of communication that is frequent, timely, truthful, & relevant.

- Service Matters – We believe that good service is practical and that great service is necessary in the pursuit of business excellence. We will pursue perfection and in so doing “catch a little excellence along the way.” (Vince Lombardi)

Chuck Omphalius

President, The 930 Plan

We specialize in providing strategies and guidance for those who are seeking a better lifestyle in retirement. Whether you have a retirement nest egg of five million dollars or $50,000, we can help you make sure it works as hard and as smart as you did in earning and saving it. Like many people, your retirement may last as long as 30 years and you simply cannot afford to make mistakes with your retirement money and run the risk of ruining your lifestyle during your leisure years. We have helped individuals and couples, at all economic levels, to achieve their financial and long-term goals and enjoy retirement by working hard and smart, and being ready for them when needed.

We’re very hopeful for an opportunity to discuss your retirement strategy so you can learn firsthand how we can be of benefit. There is no cost or obligation when talking with us by phone or meeting to discuss your circumstances and your retirement goals. We look forward to working with you soon to help you lower your stress and worry over your retirement years.

Plan For Your Future

Home

What is 401 plus 529?

We want to change the way you save!

Welcome to The 930 Plan

We specialize in providing strategies and guidance for those who are seeking a better lifestyle in retirement.

There is no one “best place” to put your retirement money because each individual and couple has unique requirements, different tolerances for risk, and need their money at different times. Likewise, there is no one place to keep your money that fits everyone for exactly the same reasons. Your unique circumstances must be taken into consideration if you seek to find the “most favorable place” for your retirement money.

We have helped individuals and couples, at all economic levels, to achieve their financial and long-term goals and enjoy retirement by working hard and smart, and being ready for them when needed.

We’re very hopeful for an opportunity to discuss your retirement strategy so you can learn firsthand how we can be of benefit.

Ask Us A Question

[contact-form-7 id=”113″ title=”Home Page”]

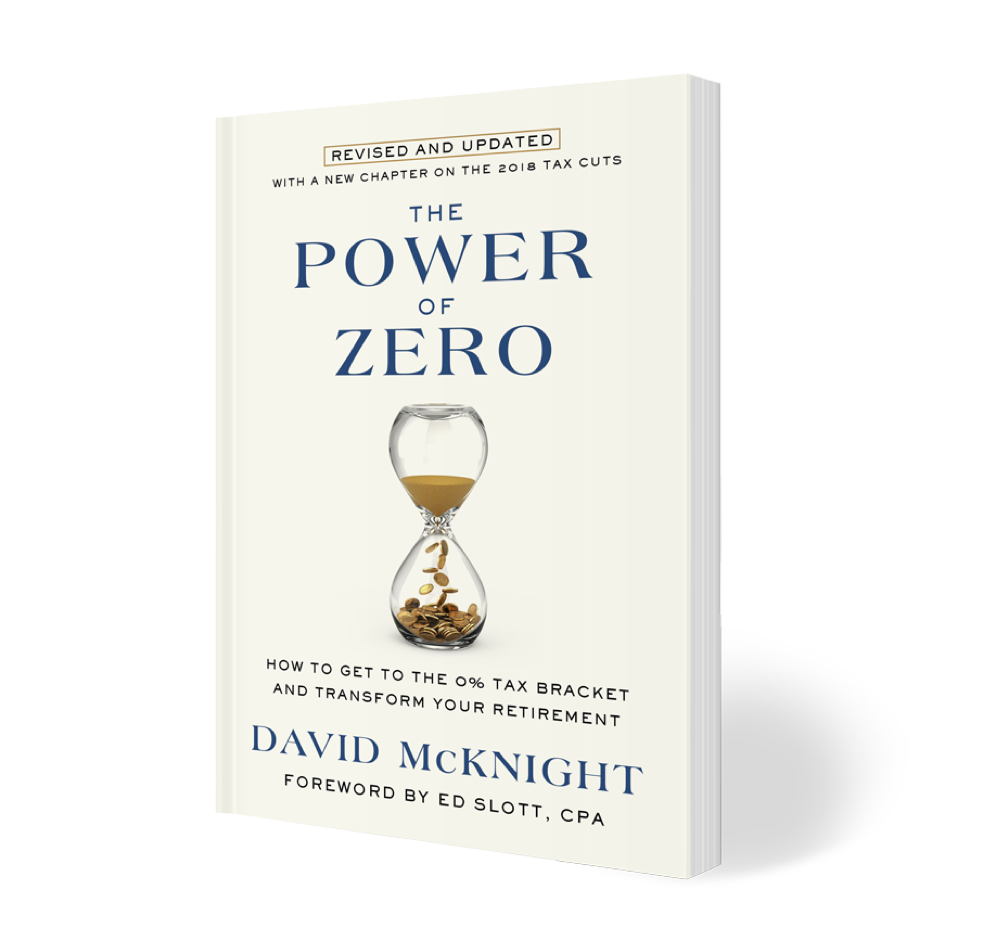

Sign up for a Complimentary Consultation and Book

SIGN UP TO RECEIVE YOUR FREE COPY

Recent News

Lowering Interest Rates: Good for the Economy and the Markets?

Interest rates can positively ...

Read moreInflation and Taxes Could Rise. Are You Ready for Retirement?

Americans are starting to see ...

Read moreNeed to Roll Over Your 401(k)? Consider a Fixed-Indexed Annuity

When you leave your employer, ...

Read more